Eastleigh Borough Ahead in First Home Sales

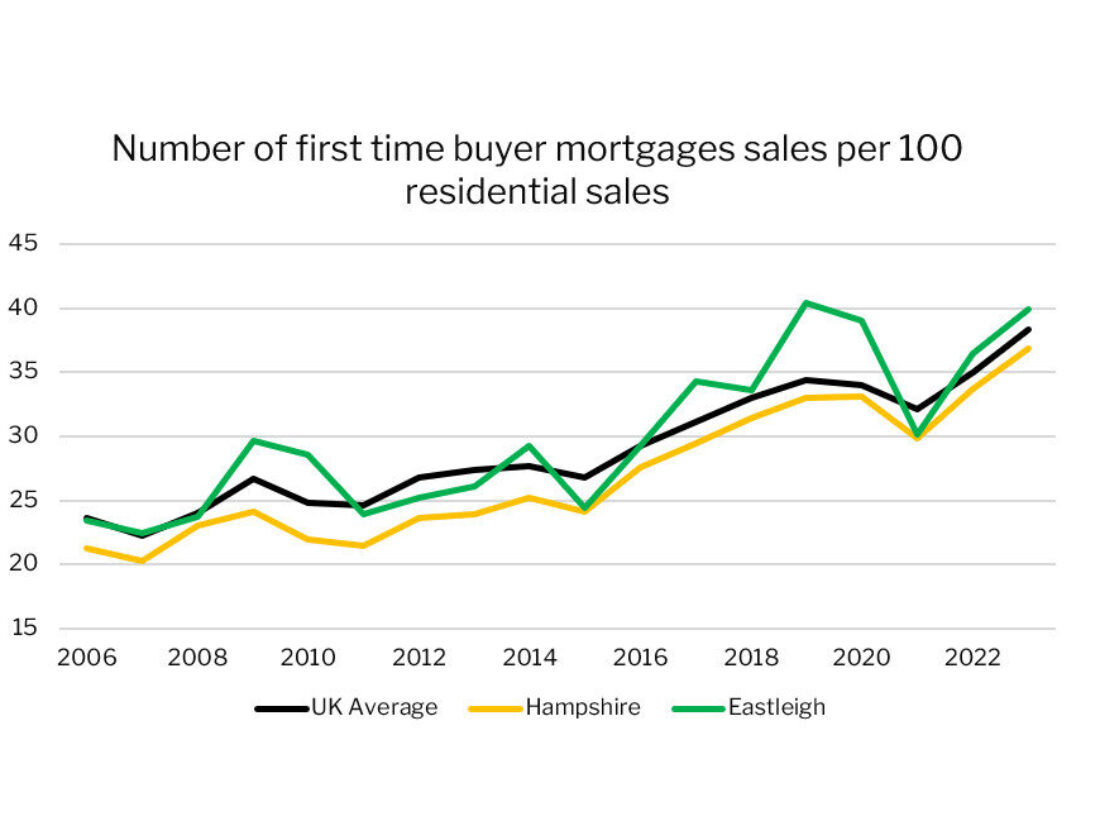

For the first time, the Office for National Statistics (ONS) has released local‐authority data on first‐time buyer mortgage sales, and Eastleigh Borough stands out. In 2023, nearly 40% of all residential sales in Eastleigh were by first‐time buyers, surpassing both the Hampshire average (36.8%) and the national rate (38.4%). This strong presence of first-time buyers underscores the Eastleigh Borough’s enduring appeal as a vibrant and accessible place to call home.

Since 2007, Eastleigh has consistently outperformed regional and national averages. Even as first-time buyer activity dipped to a 10-year low in 2023, likely driven by rising living costs, higher house prices, and stamp-duty burdens, Eastleigh remains a standout market for those taking their first steps on the property ladder.

To reinvigorate first-time buyer confidence, new government support schemes, increased lender thresholds (such as NatWest’s raised lending limits), and adjustments to income-to-borrowing ratios by the Financial Conduct Authority are expected to boost buyer confidence.

eastbrooke homes’ Tailored Support for First Time Buyers

At eastbrooke homes, we understand the unique challenges first‐time buyers face. That’s why we’ve designed a suite of services and incentives to make your move as smooth and affordable as possible.

1. Expert Guidance Every Step of the Way

Our dedicated sales team brings deep industry knowledge and local expertise. Whether you’re navigating mortgage applications or choosing fixtures and fittings, we’re on hand via phone, email or in person. We’ve also partnered with Fox & Sons to deliver an exceptional buying experience, providing extra support from initial enquiry through to completion.

2. Shared Ownership; Your Path to Ownership

Shared ownership (or “part rent, part buy”) lets you secure a percentage of your home with a smaller deposit and pay rent on the remainder. Over time, you can increase your share until you own 100%. It’s an ideal route for first‐time buyers seeking to get onto the ladder without stretching their budget.

3. Flexible Buying Incentives

We’re developing bespoke incentives designed with first‐time buyers in mind. These may include:

- Contributions towards legal fees

- Stamp‐duty support

- Deposit contributions

Our goal is to ease your upfront costs and bring your new home within reach.

Join Eastleigh’s First-Time Buyer Community

Despite recent market headwinds, Eastleigh remains a stronghold for first-time buyers, with nearly two in five new homeowners having never owned a property before. At eastbrooke homes, we’re committed to helping you seize this opportunity with tailored guidance, flexible ownership models and meaningful incentives.

Ready to take your first step on the property ladder? Visit our website for expert buying guides, or contact our sales team today to discover how eastbrooke homes can make Eastleigh your home.

Data source: Office for National Statistics (FTB mortgage sales by local authority, 2006–2023).

Related articles

Ground Source Heat Pumps – Your Questions Answered

At The Lower Acre, sustainability isn’t just a concept; it’s a commitment woven into every detail of our community. From thoughtful design to innovative energy…

Read moreFrom Design Studio to Show Home

The eastbrooke homes team has started the creative journey for The Lower Acre show homes, and the results are already shaping up to be something…

Read moreBack to School Made Easier With a Dedicated Study Space

As students return to school after the summer, we want to emphasise the importance of having a dedicated space for homework and study. Many of…

Read more